Investors Financial Information

4Q24 Key Figures

NetSales

million pesos

9,712

+9.3%

OperatingIncome

1,461

million pesos

+17.0%

Mayority

Net Income

429

million pesos

15.9%

EBITDA

1,764

million pesos

13.0%

Net Debt-to

EBITDA Ratio

1.01x

Average Debt Maturity

4.4 years

* Figures in percentage reflect growth compared to the end of the first quarter of 2025.

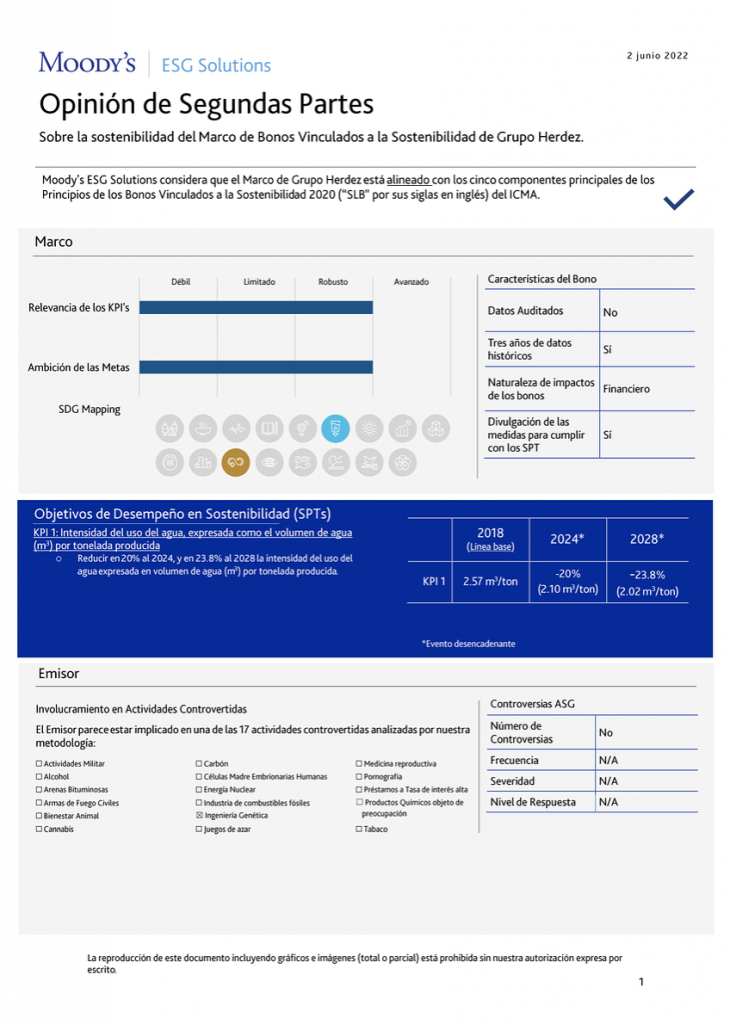

| 1Q2025 | Margin (%) | 1Q2024 | Margin (%) | Var (%) | |

|---|---|---|---|---|---|

| Net Sales | 9,712 | 100% | 8,886 | 100% | 9.3% |

| Gross Profit | 3,954 | 41% | 3,500 | 41% | 13.0% |

| Operating Income | 1,461 | 15% | 1,249 | 15% | 17.0% |

| Consolidated Net Income | 1,009 | 10% | 840 | 10% | 20.1% |

| EBITDA | 1,764 | 18% | 1,561 | 18% | 13.0% |

| Total Assets | 41,429 | ||||

| Total Debt | 10,490 | ||||

| Total Liabilities | 22,437 | ||||

| Shareholders' Equity | 8,345 | ||||

| Net Debt-to-EBITDA ratio | 1.01 | ||||

| Net Debt-to-Equity ratio | 0.36X | ||||

Our Four Strategic Guiding Principles

- 1. To maintain and form partnerships through the development of market intelligence.

- 2. To implement technologies that allow us to accelerate innovation, operational, and communication processes with consumers.

- 3. To foster sustainable management, prioritizing water conservation and efficient energy use.

- 4. To support and create growth by developing talent and investing in infrastructure.